Probability of Success (Ps) and Probability of Occurrence (Po)

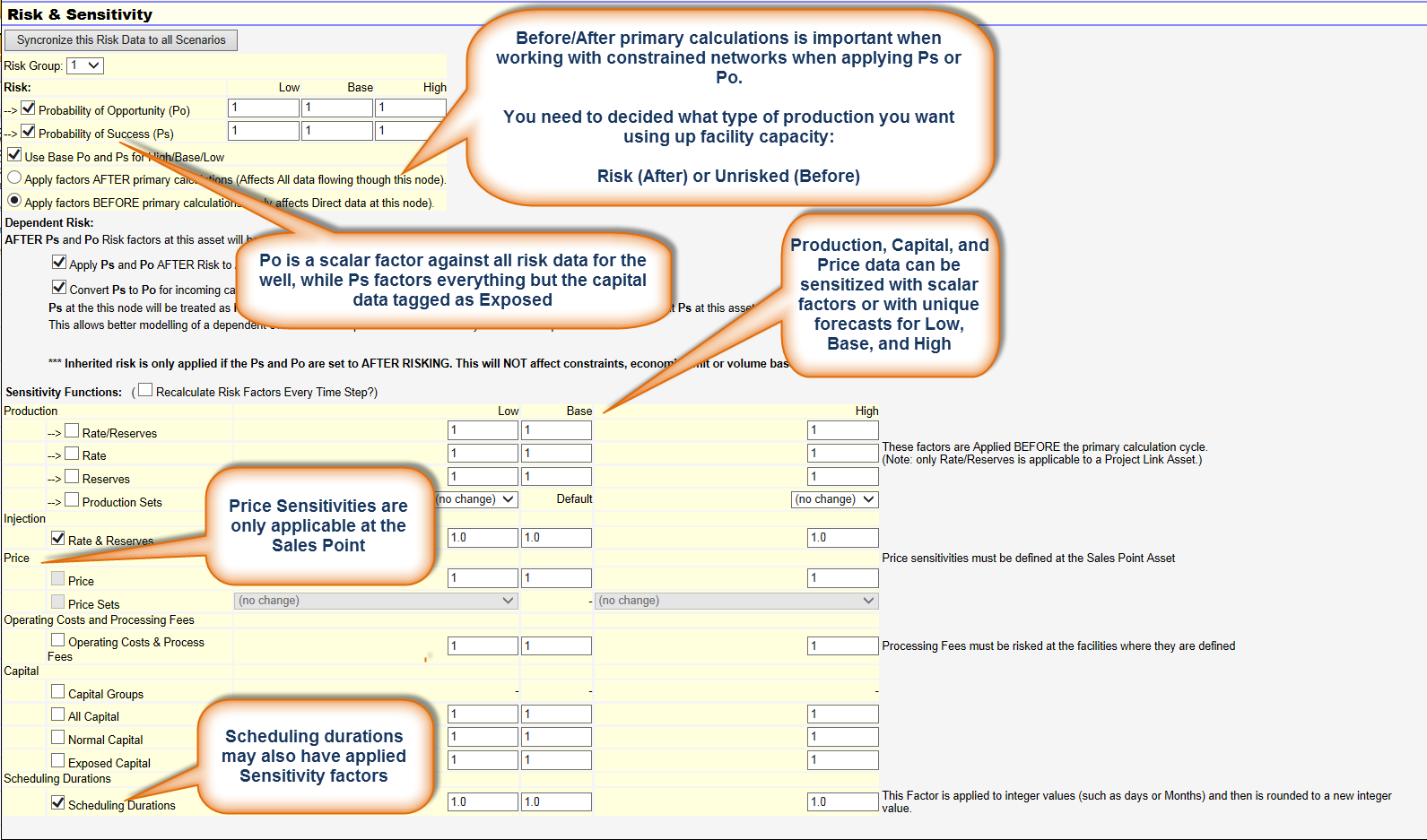

Probability of success and probability of occurrence are equivalent when there is no exposed capital. Probability of Occurrence (Po) is multiplied by all aspects of the case (Reserves, costs, revenues, fees, taxes etc.), whereas probability of success (Ps) does not affect any Capital items identified in the Capital Dialog as being "Exposed". The Po and Ps factors are entered at an Asset level in the Risk & Probability of Success Dialog. Refer to Ps Vs Po (Exposed Capital) for more detail. The default base risk has a value of 1. For example, an exploratory well will have a Ps associated with the geological location. Specific data types within an asset can also be risked using the Sensitivity settings. Each of the broad data categories for an asset can be assigned a scalar factor to represent a low, base and high level of risk. Production, capital and price data can also have unique forecasts representing low, base and high.

Risk Settings (High / Base / Low)

Enersight can define and run 3 Project Risk Settings. The risk setting names are predefined, however what they represent is defined at an Asset level. The Risk Settings can be either factors applied to the data, or alternatively specific values can be selected (in the case of production declines, capital and prices). When reporting the results, the different Risk Settings are referred to as Risk Results.

Unrisked View

Within the Scenarios Tab, in the risk drop down, when you select “None”, all the risk aspects, including Po and Ps are turned off. For Capital the Base Capital group is used, and for Declines, the default decline.

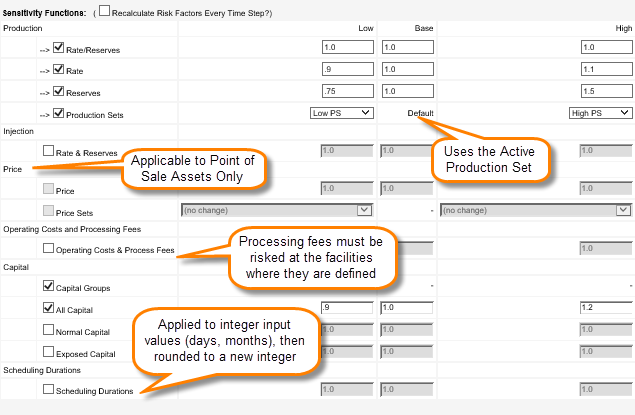

Risk Sensitivity Factors

The Risk Sensitivity factors are only applied in assets where the factors have been turned on. If there are no options checked, then there will be no factors applied. The factors apply to the values in the specific asset only. Each of the broad data categories for an asset can be assigned a scalar factor to represent a low, base and high level of risk. Production, capital and price data can also have unique forecasts representing low, base and high. Production data is broken out into all capital, normal capital (non-exposed), exposed capital and capital groups (unique forecasts). Injected water/steam is treated separately from the hydrocarbon forecasts ad has a separate scalar factor. Price sensitivities can only be applied at a sales point. Scalar factors or unique price sets can be applied. Operating costs and processing fees share the same sensitivity factors.

Click image to expand or minimize.

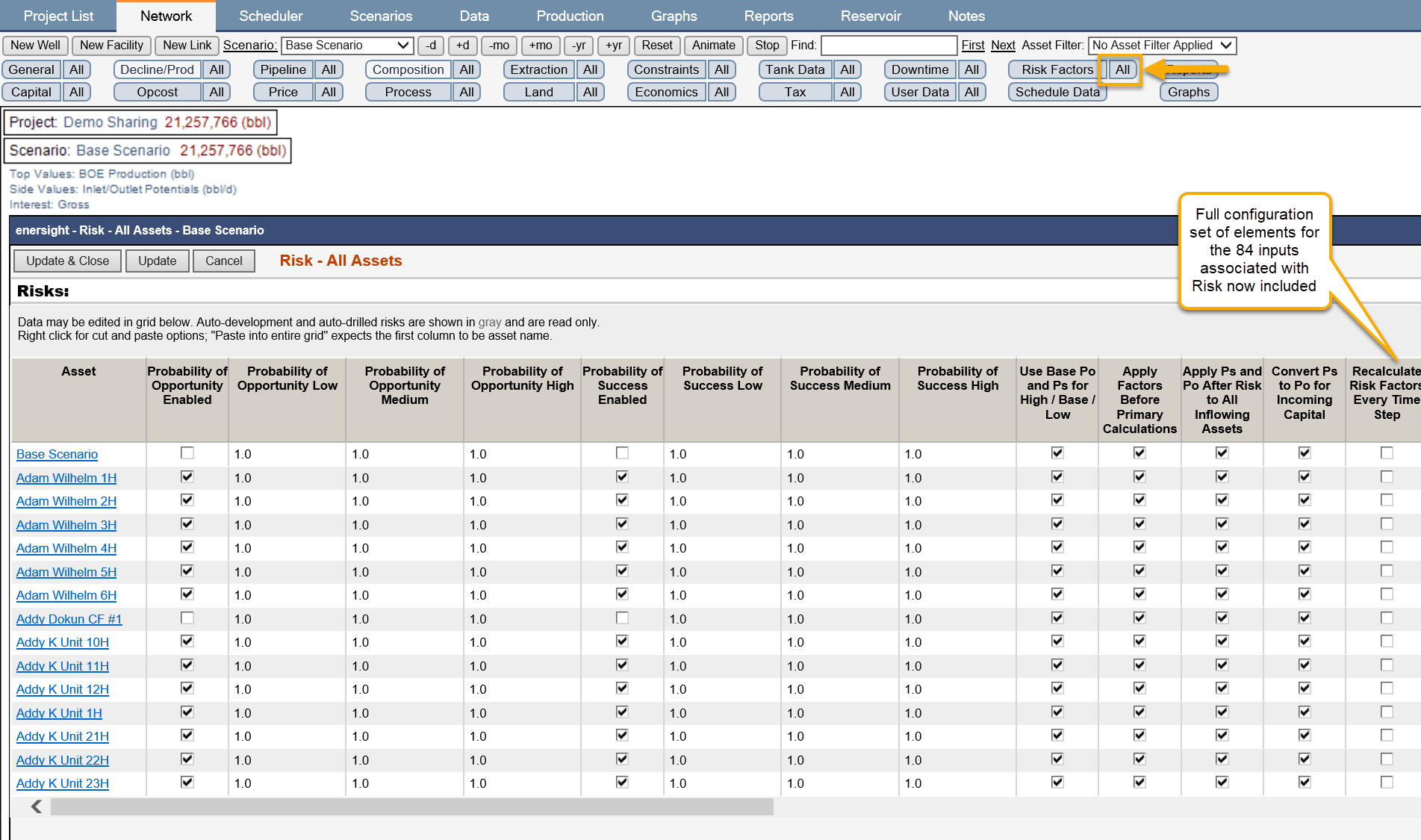

The current settings across all assets may be interrogated via the "All" button. This grid also allows for editing, copying and pasting of updated data.

Click image to expand or minimize.

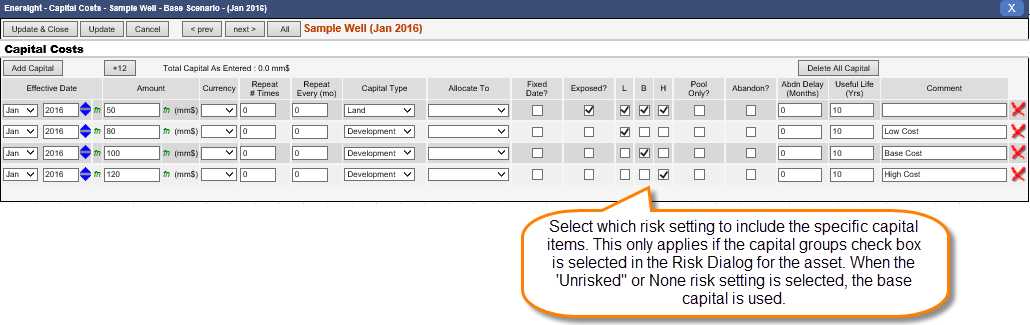

Capital Sensitivities

Capital sensitivities are broken out into all capital, normal capital (non-exposed), exposed capital and capital groups (unique forecasts). When capital is entered, it is assigned the relevant capital groups through the LBH checkboxes. An overview of all applied capital risks may be accessed through the network tab by selecting the Capital (All) blue hyperlink. Scheduling durations can also be sensitized. These factors are applied against the integer value. All risk settings for an asset may be selected by clicking on the blue Risk hyperlink in the network tab.

Click image to expand or minimize.

Details on specific element types and how they affect the calculation are described in the table below:

| Setting | Description |

|---|---|

| Rate & Reserves | Applied to both the monthly rate and total reserves. Scales all the monthly values by the same value, and does not change the life duration. This is applied after and in addition to any Rate or Reserves or Decline Sets sensitivities that are defined and active. |

| Rate | Decline Curves: Applied to the initial rate for the decline, the program then recalculates the decline and adjusts the free element as defined in the decline input. If the free element is recoverable Reserves, then these will be scaled as well. Arrays: This is applied to arrays by reducing the rate and adjusting the period of time a given rate is applied to deliver the same volume. Each rate is extended or reduced in time, also shifting the start point of the next lower rate. This is done on a fraction of a month basis, so any given month could be part of one rate and part of another. |

| Reserves | Decline Curves: Applied to the initial rate for the decline, the program then recalculates the decline and adjusts the free element as defined in the decline input. If the free element is recoverable Reserves, then these will be scaled as well. Arrays: This is applied to arrays by adjusting the period of time a given rate is applied to deliver the new volume. Each rate is extended or reduced in time, also shifting the start point of the next lower rate. This is done on a fraction of a month basis, so any given month could be part of one rate and part of another. |

| Decline Sets | You can define specific Decline Sets to use for the High, Base or Low Risk Settings. This selection is set prior to any of the Production Sensitivity factors being applied. |

| Rate and Reserve (Injection) | Rate and Reserve scaling as per above but only applied to injected water or steam. |

| Price | Applied to the prices directly. These are applied after any specific Price sets are selected. Applicable to assets which are sales points only. |

| Price Sets | Specific Price Sets can be selected for the Individual Risk Settings. Applicable to assets which are sales points only. |

| Operating Cost and Processing Fees | These are applied to all the Fees and costs, including any receivable fees. Must be applied at the facilities where the costs / fees are defined. |

| Capital: All | Applied to all capital after applying the Capital Groups and the General or Exposed sensitivity factors. |

| Capital: Normal | Applied to non-Exposed Capital in addition to All e.g. the factors are multiplied (0.5 x 0.5 = 0.25) |

| Capital: Exposed | Applied to Exposed Capital in addition to All e.g. the factors are multiplied (0.5 x 0.5 = 0.25) |

| Capital: Capital Groups | Within the Capital Dialog inputs, you can define specific capital items as being included or excluded from the specific Sensitivity Sets (Low, Base or High). These differentiations are only used if the Capital Groups Sensitivity factor is checked as applied. |

| Scheduling Duration | Applied to integer durations (such as days or months) which are then rounded to a new integer value. |

An alternative way of specifying risked capital input values as a more specific number (rather than a ratio of the base) is to define within the capital entries which risk band the entry exists under.

Click image to expand or minimize.